Nvidia Becomes First $4 Trillion Public Company Surpassing Microsoft and Apple

The Chipmaker Rides the AI Boom to a Historic Market Cap Milestone, Despite Trade Hurdles and Rising Competition

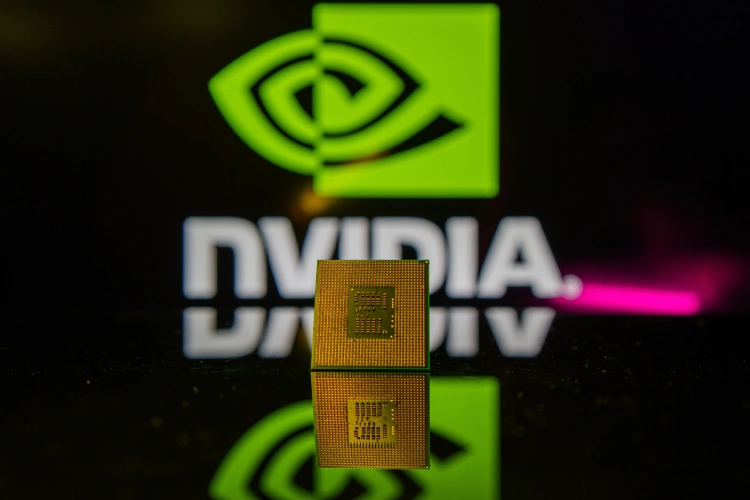

Nvidia has reached a new high point in global finance, closing Thursday with a market value exceeding $4 trillion. The company’s shares ended the session at $164.10, securing a total valuation of $4.004 trillion. With this, Nvidia has pulled ahead of both Microsoft and Apple to become the most valuable publicly listed company on Earth.

This achievement comes just a year after Nvidia first reached a $1 trillion market cap in mid-2023. That sharp upward trajectory outpaced the rise of other major U.S. firms. Apple, once the world’s top-valued company, now holds a valuation of about $3.17 trillion following a dip in its share price. Microsoft, at roughly $3.73 trillion, trails Nvidia after months of trading leadership positions.

Nvidia’s rise is closely tied to the booming demand for artificial intelligence systems. Its processors are now essential to the data centers that drive AI products across the tech sector, from search tools and cloud services to autonomous machines.

The Engine Behind the AI Infrastructure Surge

Initially known for its graphics chips used in gaming computers, Nvidia has transformed into the backbone of global AI development. Its high-performance semiconductors now handle the intense computing needs of firms like Google, Amazon, Meta, and Microsoft, all of which are investing heavily in AI-powered services.

The firm’s financial results reflect that transformation. Revenue for the quarter ending in April reached $44.1 billion, marking a 69 percent increase year over year. The company also introduced a new chip model in March—Blackwell Ultra—designed to improve the efficiency of advanced AI systems by handling more complex reasoning tasks.

On a recent earnings call, Nvidia CEO Jensen Huang noted that virtually every sector from logistics to education will eventually integrate AI tools.

Geopolitics and New Players Could Shift the Landscape

Nvidia’s momentum, however, is not without potential obstacles. Tensions between the United States and China have already affected its bottom line. Due to restrictions on exporting its top-tier AI chips to Chinese firms, the company estimates it missed out on around $2.5 billion in revenue during the last fiscal quarter.

Additionally, a low-cost AI model released earlier this year by Chinese startup DeepSeek raised eyebrows in Silicon Valley. The startup’s offering raised the question of whether AI advancement necessarily requires expensive chipsets.

Commenting on the risks, Ipek Ozkardeskaya of Swissquote Bank pointed out that while Nvidia leads now, more accessible alternatives or ongoing trade disputes could pressure its market dominance.

Huang, meanwhile, has become a more visible figure in Washington circles. He recently joined a U.S. tech delegation to Saudi Arabia and has aligned Nvidia with Project Stargate—a major public-private AI infrastructure initiative launched earlier this year.

A Shift in What the Market Values Most

Crossing the $4 trillion threshold does more than signal Nvidia’s success. In earlier decades, consumer electronics and software were king. Today, raw computing power, and the ability to run and scale intelligent systems appears to be the crown jewel.

According to analysts at Loop Capital, Nvidia could push even higher. Their June report suggests a $6 trillion market value by 2028 is within reach if current trends hold. They argue Nvidia operates as a near-monopoly in supplying the chips needed to train and deploy leading AI platforms.